This month: how regulation may challenge Facebook’s reliance on Instagram and WhatsApp, how FMCG brands are growing in China, and the role of digital audiences for publishers.

Big changes for big tech in 2021?

The dominance of tech giants has been a brewing issue for years, but 2021 may be the year that government action finally speeds up.

Late last year, the European Union, the United States and the UK announced fresh investigations and rules into major tech players such as Alphabet, Facebook and Amazon.

The level of interest in these companies is reasonable – the triopoly of Alphabet, Amazon and Facebook earned $64bn from advertising in the third quarter of 2020, essentially brushing off the impact of the coronavirus outbreak. Meanwhile, traditional media owners saw advertising investment fall by double-digits, with the 2021 forecast not suggesting a rapid bounce-back.

One company that has a lot to be concerned about should regulators want to break it up is Facebook. Although the Facebook platform accounts for the majority of advertising revenue, Instagram has been the main driver of recent growth.

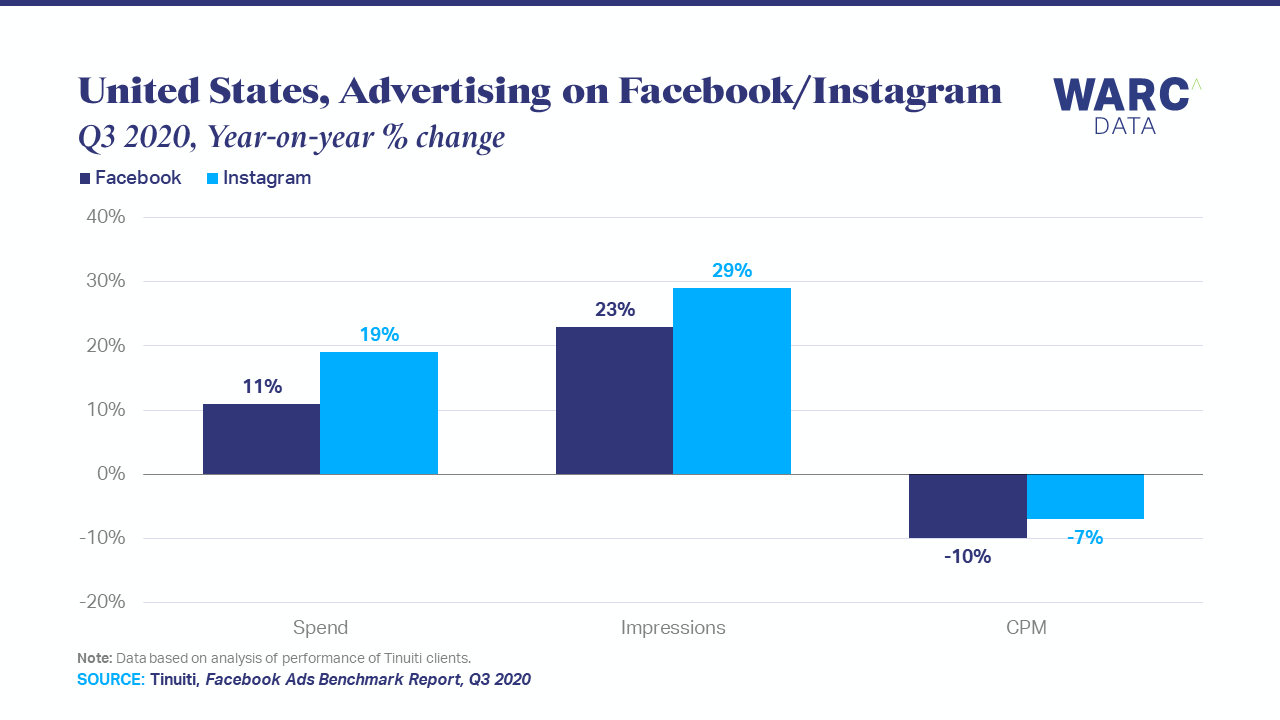

Data from performance marketing agency Tinuiti shows that Instagram advertising spend in the US rose by 19% in Q3 2020, almost double the rate of increase seen on the Facebook platform (11%).

WARC’s own survey of over 1,000 marketers found that half (52%) expect to invest more on Instagram in 2021, with a smaller 39% saying the same for Facebook. Some marketers might even be turning away from Facebook, as 12% said they expect to spend less this year. This is the highest share across the 16 different digital platforms asked about.

Consumers are also turning away from the Facebook platform. The latest company reports show that 720 million people use Instagram and/or WhatsApp daily but avoid the Facebook platform, a number that has grown by a quarter (24.8%) in 12 months.

While WhatsApp remains largely unmonetised for the parent company, it plays an important role in connecting businesses with consumers – over 175 million people message a WhatsApp Business account every day.

Both Instagram and WhatsApp are key for the future of the company, Instagram in social commerce and WhatsApp in customer service. Any regulatory pressure or a potential breakup may throw the long-term success of Facebook into a tailspin.

FMCG brands find growth in China through a variety of approaches

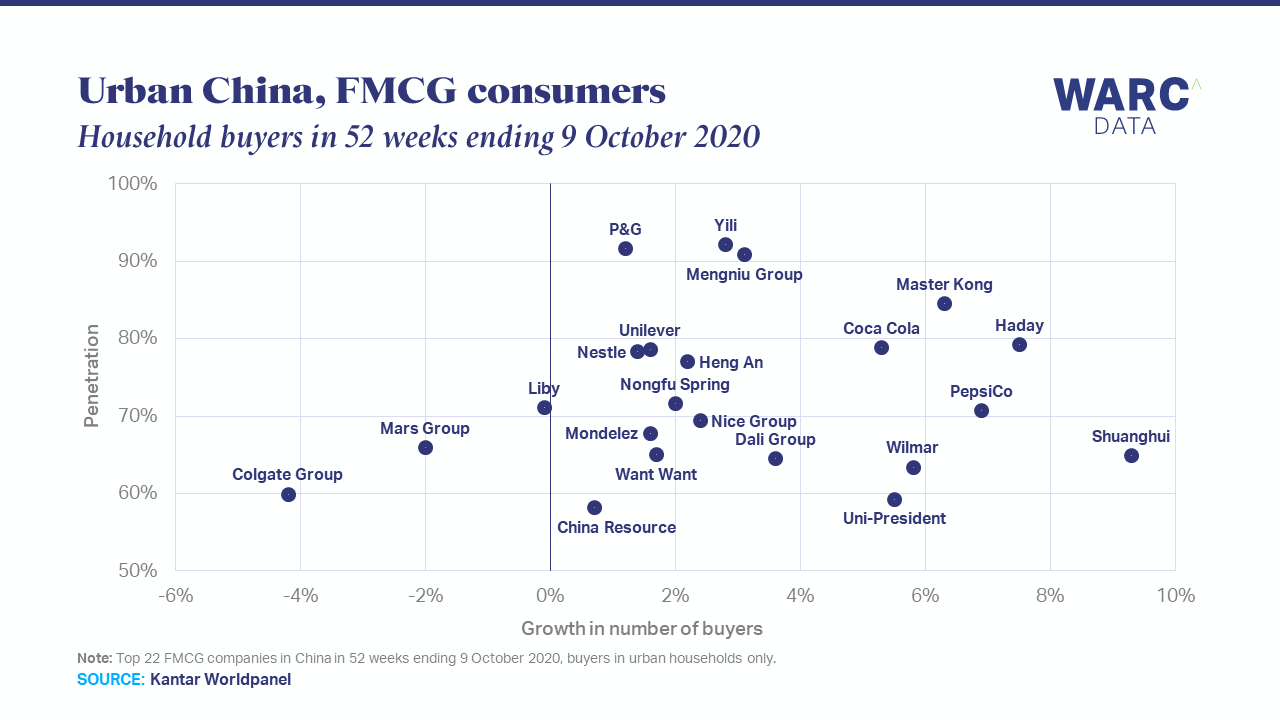

The top FMCG companies in China attracted 82 million more urban consumers in 2020, though the strategies they used to achieve this vary significantly, according to data from Kantar Worldpanel.

Dairy player Yili has tapped into growing consumer demand for health and immunity products, having overtaken P&G to become the largest FMCG company. Additional research shows that 83% of Chinese consumers expect products and services to enhance their health and wellbeing, the highest share across 22 markets.

Brands inside and out the FMCG category have reacted to this trend, as 57% of marketers in APAC say health and hygiene will have a significant impact on their 2021 strategy. Low-calorie meals offering high-quality nutrition are expected to be one area of growth in China.

Yili’s growth was also driven by online channels as it tries to make its products more accessible to China’s consumers.

However, traditional food brand Shuanghui registered the largest increase in buyers in 2020 and this was mostly driven by offline channels. The company increased its number of consumers by 9.3%, with offline consumers growing at almost twice the rate as those buying online.

Whatever the product offering or sales channel, tier 3-5 cities proved vital for FMCG brands. Kantar adds that three-quarters (75%) of total buyer base expansion came from lower-tier cities. These cities offer a largely untapped opportunity for brands but may require a different approach to that of tier 1-2 cities.

WARC clients can read more about how brands can craft better culture-relevant marketing that resonates with consumers in a changing China here.

No reprieve for publishers as the digital shift accelerates

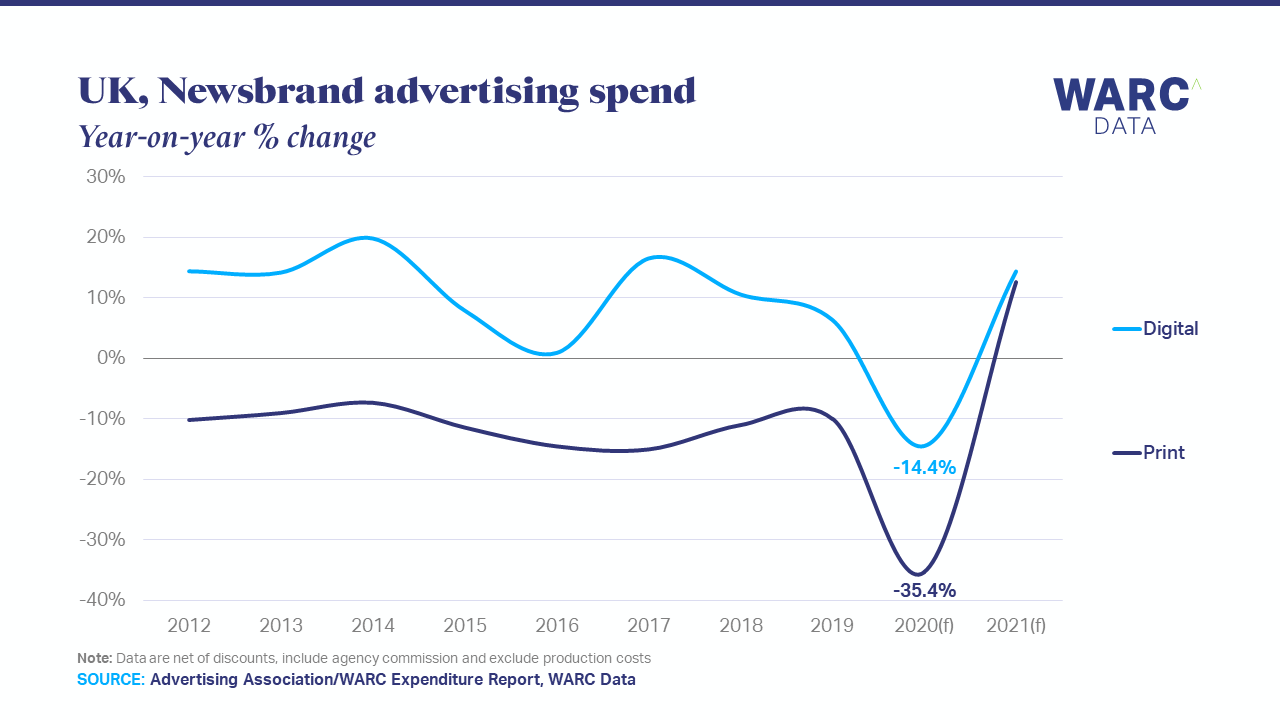

Traditional media saw advertising investment decline by double-digits in 2020 and, to make it worse for publishers, print newspapers and magazines are the only media to recover none of last year’s lost value. Instead, a shift to digital is the strategy of choice for many advertisers.

Globally, WARC Data estimates that newspaper and magazine print advertising revenue fell by a quarter last year, following almost a decade of decline. Travel & tourism, one of the worst hit sectors by COVID-19, is the fourth largest print advertiser and cut investment by almost a third.

This year will offer little in terms of a bounce-back, with the total level of print investment expected to be largely flat.

For many publishers, though, digital activity has been the area of growth.

Data from the Advertising Association and WARC shows that digital ad revenue doubled in value between 2011 and 2019. Over the same period, print investment more than halved.

Some level of support is coming from an unlikely source, with the duopoly of Facebook and Google announcing they will be paying UK publishers for news content in the future.

However, it is digital subscriptions that have generated the most attention as a way of countering the decline in print advertising revenue. For publishers, the coronavirus-induced growth in digital audiences appears to have lasted beyond the initial outbreak.

An analysis of more than 300 clients of Pugpig, which include publishers like News Corp, Condé Nast and The Economist, shows monthly app users for daily news brands rising by 79% in April 2020. This strong growth lasted throughout the summer as well, with audiences still up 74% by November.

However, attracting mobile audiences will be a challenge for many. Just 4% of mobile consumption is on news/information content, compared to 32% spent on social media platforms.

There are signs of success, though. The Times has focused on quality audiences in order to reduce subscriber churn, while the Financial Times and The Telegraph have used reader engagement to drive growth. At the same time, expanding into new content areas has proven valuable for both GQ and The San Francisco Chronicle.