The Feed

Read daily effectiveness insights and the latest marketing news, curated by WARC’s editors.

You didn’t return any results. Please clear your filters.

The Future of Measurement: four key trends

The evolution of measurement holds enormous and powerful potential for marketers, if the industry can overcome the state of decision paralysis – in an extensive new report, WARC identifies four areas to focus on with practical steps to help.

WARC’s Future of Measurement report is based on exclusive proprietary data as well as external research and reporting.

WARC members can read the full report here.

If you’re yet to subscribe, you can read a sample of the report here.

Why the future of measurement matters

Third-party cookies will finally be eliminated from online advertising this year, but only a tiny fraction of marketers are conducting holistic measurement, with a majority not using any modelling, explains Paul Stringer, WARC’s managing editor of research and insights, in an introduction to the report.

Four big ideas

The report explores four key trends across different chapters:

- AI and the growth of synthetic data

AI is set to transform market research, but the quality of output is only as good as the reliability of the data put in. Marketers will have to grow accustomed to deploying hybrid approaches. - The third-party cookie countdown

Though 75% of marketers understand their dependency on cookies, many remain unprepared for their end; interoperability of replacement systems is a big concern. - Hurdles in holistic measurement

MMM is a hugely exciting new step in measurement, but it requires some know-how to put into practice. - Closing the sustainability gap

Sustainability requires a more nuanced definition of growth, while new regulations will put pressure on brands to measure the emissions resulting from their activities.

Key quote

“With measurement continuing to evolve in several directions at once, marketers find themselves battling multiple headwinds: not only the demise of third-party cookies, but new regulations in sustainability reporting, and, of course, the growing influence and impact of AI” – Paul Stringer, Managing Editor, Research & Insights, WARC.

Connected TV and retail media central to this year’s US upfront

The US upfront is expected to be a seller’s market this year because of an improved economy, tighter inventory due to the Olympics and presidential election, and no writer’s strike, according to data from Advertiser Perceptions.

Channels including connected TV and retail media are also expected to be a greater part of the mix.

Why the US upfront sales matters

The annual upfront TV ad sales season in the US is a key indicator of the health of the media and marketing ecosystem, taking into account the popularity of programming, the size of ad budgets, the state of the overall economy, and how new media channels fit into the overall picture.

Takeaways

- Advertising Perception’s (AP) March survey of 156 US advertisers who influence upfront video budgets showed that 34% plan to increase their upfront allocation this year, and anticipate allocating a median of 45% of their upfront video budgets to CTV, up from 40% a year ago. AP believes CTV spending will outpace national linear by 2026.

- Access to media brand data (including retail data) has emerged as the number one reason advertisers say they plan to purchase TV inventory during the upfront, with brands expressing interest in products built on streamers’ first-party viewing data, retailer sales data or ACR (Automatic Content Recognition) data from Smart TV and streaming device providers.

- As currency solutions besides Nielsen receive accreditation from the Joint Industry Committee (JIC), only 41% of advertisers say they plan to transact solely on traditional currencies; 59% plan to use alternative currencies either alongside Nielsen demos or exclusively.

Key quote

“For buyers, CTV will be a more central part of upfront conversations than in years past. And with the Olympics and presidential election this year, advertisers may need to be more aggressive with their plans than in prior years if they want to lock in with specific inventory at guaranteed rates” – Eric Haggstrom, director of market intelligence, AP.

Alcohol sector lacks sonic assets, finds study

Expensive licensing and uninspiring stock music have primed the alcohol sector for an overdue investment into owned sonic assets, finds a study.

Sonic branding agency Amp had its research and insights team analyse and rank the top 50 alcohol brands by their use of music and sound over the last 12 months based on the top five brands from each sector by market share.

Why sonic assets matter

Strategic use of sound can enhance authenticity and foster cognitive function by tapping into nostalgia, driving salience and generating long-term consumer connections; alcohol brands that leverage sonic branding will be front of mind.

Key insights

- Pilsner Urquell, with 27% owned music usage, leads the market in sonic performance and is the only bestselling brand with a sonic logo.

- Havana Club, Michelob Ultra, Belvedere and Modelo round out the top five ranking with descending sonic scores.

- Beer brands performed well in the analysis, claiming 50% of the top 10 slots in the ranking.

- The alcohol industry is composed of many sub-sectors, all delivering different experiences targeted at distinct demographics.

- Brands have been crafting quality products from champagne to hard seltzer with impressive visual identities aimed at target audiences; but from heritage bubbly to flashy fizz, both sub-sectors struggle in the sonic department.

- Champagne brands use a combined 90% “stock music” and “no music” in external marketing communications.

APAC consumers most willing to pay more for sustainable hotels

APAC consumers are more likely than those in EMEA and AMER to pay more for sustainable hotels, YouGov research has found.

Headline figures

- YouGov surveyed 17 international markets and found that over half of consumers in APAC (55%) say they are willing to pay more to stay at an environmentally sustainable hotel compared to a regular one.

- This compares with only around two-fifths (41%) of consumers in Europe, the Middle East and Africa; and 38% in North, Central and South America.

Why sustainable hotels matter

Amid stronger demand for sustainable travel and responsible tourism in Asia Pacific, brands in the region that invest in eco-friendly hotels by building them, or retrofitting existing properties to make them greener, can appeal to those willing and able to pay more for such accommodation.

Key insights

- Consumers who are willing to fork out a 10% green premium make up around a quarter in APAC (27%) and EMEA (23%) but just a fifth in AMER (20%).

- The percentage of those willing to spend over 10% more to stay at eco-friendly hotels makes up 28% in APAC compared to 18% in EMEA and AMER.

- Consumers who resided in the UAE, India, Indonesia, Hong Kong and Mexico were more likely than not to express willingness to pay more for a sustainable hotel stay.

- 73% of UAE consumers are willing to fork out more, ahead of almost seven in 10 Indian consumers (69%), and three in five consumers in Indonesia, Hong Kong (both 61%) and Mexico (60%).

- Those willing to spend over 10% more for a greener hotel booking made up almost half of consumers in the UAE (48%), two-fifths in India (39%) and a third in Indonesia (32%).

- Among markets in Europe, Italy has the highest proportion of consumers who are willing to pay more for a sustainable hotel stay at 45% – above the international average (43%).

- The willingness to spend more to stay at eco-friendly hotels stands at around two in five in Australia and Singapore (both 42%), and Spain (41%).

- Poland and Denmark are both at 38%, and Sweden is 37%, while it is one in three in Britain (36%), Canada (35%), Germany (35%), and France (34%), ahead of just 28% in the US.

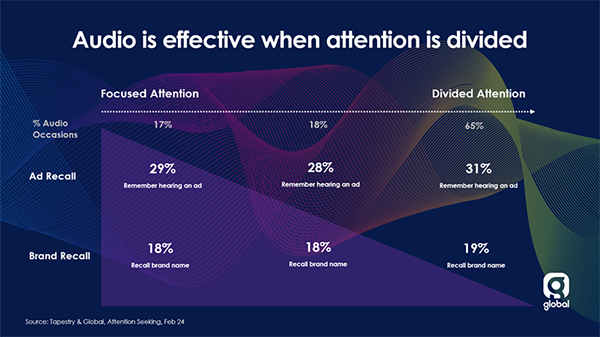

Audio media effective ‘regardless’ of attention levels

Audio ads can be effective no matter the level of attention a listener provides, a new study claims, surprisingly finding that people whose attention is divided have slightly better ad recall than those who are more focused.

A two-pronged approach

Ailsa Mackenzie, group strategy director at audio and OOH media owner Global, shared the new research at The Future of Audio and Entertainment conference in London.

Global first undertook a lab-based neuroscience study, measuring participants’ responses to an ad break when just listening, and then when carrying out a task at the same time. The media owner then applied the neuroscience metrics to a diary research project to understand the audio-listening behaviours of over 3,000 people.

Key insights

- Listeners tend to give more “focused attention” to audiobooks and podcasts, with music, radio and streaming more likely to be listened to in tandem with other activities.

- More focused listening occurs mostly during leisure time in the evening, whereas attention tends to be more divided when commuting or working during the daytime.

- Levels of ad and brand recall were found to be slightly higher for those with divided attention: 31% remembered hearing an ad while carrying out another task versus 29% offering more focused attention.

- The study also found “stronger neuro responses to brand moments” when attention was divided (+18% stronger engagement, +204% stronger activation).

Why measuring audio attention matters

It’s a point that has been made previously by organisations including Thinkbox, namely that eye-tracking techniques fail to fully capture the relationship between audio media and consumer attention. Studies like this help to fill the gaps in advertisers’ understanding of the role of non-screen-based media on attention.

Key quote

“Attention is shared across our senses and activities, in a constantly changing balance. But the answer isn’t to create campaigns that demand more attention. We need to change the narrative to make the most of the attention we’ve got” – Ailsa Mackenzie, Group Strategy Director, Global.

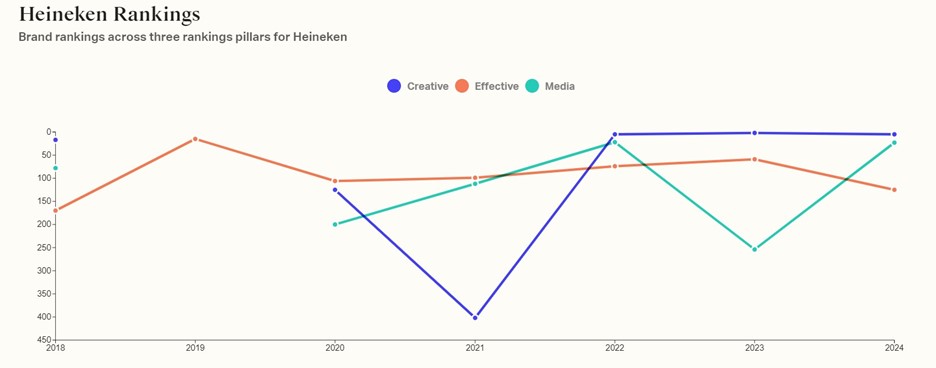

WARC Creative: unpacking Heineken’s marketing evolution

Heineken has consistently ranked among the top brands for creativity with its highly recognised campaigns, but the brand has struggled to match the same level of success when it comes to effectiveness and media, analysis reveals.

This profile, available exclusively to WARC Creative members, examines the performance of Heineken in the WARC Rankings and explores the approach it has taken to marketing, comparing it to WARC’s comprehensive set of creative effectiveness frameworks.

Why Heineken matters

Heineken is one of the most recognisable and valuable alcoholic drinks brands globally. In terms of its advertising efforts, it is renowned for its creative campaigns, which frequently appear in the Creative 100. Since 2022, the brand has consistently held a position in the top 10.

In last year’s Creative 100, Heineken came second for the most creative brand globally, with four of its campaigns in the top 100. While Heineken hasn’t replicated the same level of success in the Effective and Media 100, it has achieved some impressive results over the years, peaking at 15th in the 2019 Effective 100 and 23rd in both the 2022 and 2024 Media 100.

Takeaways

- In 2022, the campaign ‘Shutter Ads’ ranked no. 7 in the Creative 100 and no. 38 in the Media 100. Its success continued into the following year, ranking 25th in the Creative 100. It was created to support Heineken’s trade partners through the pandemic by turning bars’ closed shutters into media space.

- Heineken places a significantly higher emphasis on creating informative and educational content than the wider industry does: 37% of Heineken’s campaigns have this strategy compared to just 23% for the industry.

- Over a quarter of Heineken’s campaigns lead with mobile and apps, more than any other channel. In contrast, the wider industry predominantly favours television and connected TV as the lead channel for its campaigns.

Go deeper

WARC Creative members can access the full analysis, complete with rich analysis of the brands campaign objectives and results, in-depth explorations of the work and of Heineken's competitive environment.

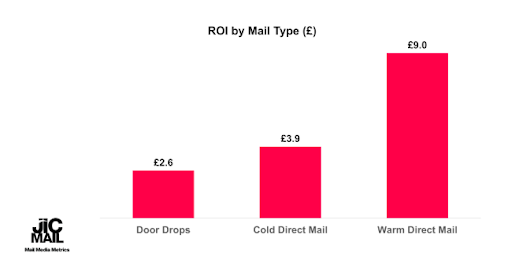

JICMAIL adds door drop data to its benchmarks

The latest JICMAIL Response Rate Tracker reveals that the average warm direct mail campaign has a response rate of 7.9%, cold direct mail 0.9% and door drops 0.6%.

Background

Last March the industry body assessed for the first time how responsive consumers are to acquisition- vs retention-based marketing strategies with mail. Its new research is based on more than twice as many campaigns from an increased number of organisations and now includes data on door drops.

Why mail benchmarks matters

The benchmarks are a useful tool for advertisers to understand where direct mail sits in the wider marketing ecosystem. JICMAIL’s Ian Gibbs, director of data leadership and learning, adds: “Having accurate benchmarks by which to set targets, track relative performance, and validate measurement results are all crucial steps in making the most out of a performance-oriented Direct Mail or Door Drop campaign.”

(And they will also complement the Thinkbox study published this week which breaks down the profit generated by advertising in various channels but which doesn’t include direct mail).

Key stats

- Warm DM has over double the ROI of cold DM (£9.00 vs £3.90) due to higher response rates and 80% lower CPAs (but cold DM is a vital channel for customer acquisition).

- Average Order Value is over x2.5 higher for cold vs warm DM, pointing toward the high value that a new customer obtained via mail can bring to an organisation once the heavy lifting of acquisition is done.

- With an average response rate of 0.6% and ROI of £2.60, door drops can also be an important mail channel for customer acquisition and are being used to good effect by a wide range of advertising sectors.

- The highest response rates for warm direct mail are found in the medical category (25.9%), while for cold DM, the highest rates are found in the Retail / Online Retail and Mail Order sectors (1.0%).

- For door drops, the highest response rates were found in Retail / Online Retail (3.0%).

Sourced from JICMAIL

Tata Consultancy predicts call centres' demise but what will brands lose?

The CEO of Tata Consultancy Services believes that artificial intelligence will lead to the end of most call centres – but amid growing dissatisfaction with customer service, does the rise of an AI alternative open up an opportunity?

Why the rise of AI customer service matters

AI is attractive mostly because it can help businesses do relatively mundane tasks quickly and cheaply – though as Meta’s recent expenditure on AI development suggests, it’s not quite the money-saving utopia that is being imagined in some quarters.

The end of the call centre?

Despite little job reduction so far, the consultancy arm of the Indian conglomerate envisages a world with “minimal” need for call centres, as chatbots replace a key industry across much of the world. This could happen as soon as 2025, CEO K. Krithivasan tells the FT.

“We are in a situation where the technology should be able to predict a call coming and then proactively address the customer’s pain point.” In fairness, he does also acknowledge the ferocity of the current hype cycle, and hastens to add that the greatest impact of the technology will most likely be in the long term.

In context

Such optimism about the capabilities of AI for predicting pain points and – crucially – dealing with them chime nicely with the kinds of digital transformation services that TCS dispense, with the AI business doubling quarter on quarter and set to continue growing fast.

The comments come amid a spate of stories about declining customer satisfaction following pandemic-era lockdowns.

Aside from a general sense of diminished customer service (largely the result of more complex customer problems), adoption of this technology will depend heavily on the category and brand position of the companies taking it up.

In sectors where customer care – banking and travel, for instance – are a significant differentiator, the brand implications of great customer service is its ability to drive higher prices.

Ultimately, the question of whether this will be effective comes down to the basics of customer-centricity: listening to customers is easy, delivering what they want more difficult.

The doorman fallacy

Rory Sutherland explores the idea of the ‘Doorman Fallacy’ in his book Alchemy:

“The ‘doorman fallacy’, as I call it, is what happens when your strategy becomes synonymous with cost-saving and efficiency; first you define a hotel doorman’s role as ‘opening the door’, then you replace his role with an automatic door-opening mechanism.”

While this may constitute a saving – efficiency – it also undoes part of what made that hotel’s overall offer effective.

Sourced from the Financial Times, WARC

Duolingo’s playful mascot boosts TikTok performance

Duolingo, the language learning app, has driven engagement on video-sharing apps by making playful use of “Duo”, its owl mascot and distinctive brand asset.

Why distinctive brand assets matter

Distinctive brand assets, whether that is a logo or mascot, can help a brand stand out when they are deployed effectively. Combining these assets with a clear, consistent and engaging tone of voice can have a multiplicative impact.

Takeaways

- In July 2021, the brand posted a TikTok video where Duo walked around Times Square, reminding passersby to do their lessons.

- Since then, its TikTok strategy has primarily used tongue-in-cheek content that...

This content is for subscribers only.

Sign in or book a demo to continue reading WARC’s unbiased, evidence-based insights that save you time and help you make marketing choices that work.

Microsoft uncovers five factors driving brand preferences in tech

Microsoft used research analysis to determine what drives brand love in the tech world, concluding that convenience is a major factor, while positive feelings lead to consumer forgiveness, brand loyalty and a willingness to pay a price premium.

The study – in partnership with data agency SHARE creative – found that Apple had the highest level of brand love overall and is particularly liked for its wearable tech and laptop performance. Microsoft, in contrast, saw strong appreciation and loyalty within the realm of gaming.

Context

The tech giant analysed over 30,000 social media conversations using an algorithm and research...

This content is for subscribers only.

Sign in or book a demo to continue reading WARC’s unbiased, evidence-based insights that save you time and help you make marketing choices that work.

Pharma brands can tap social media influencers

Seven in ten Americans either follow or seek out health content or learn about health/medical issues from social media – and the vast majority of those who engage take some form of action.

That’s according to a survey conducted by Ogilvy, which has just launched a health-first suite of global influencer marketing services.

Key findings

- Almost all of those who engage (93%) with health-related social media accounts report taking some action as a result of seeing health or medical related social media content.

- Over half (54%) scheduled an appointment (e.g. check-up, for an issue or preventative screening) after seeing health or medical-related social media content.

- Of those who are engaged with health-related social media accounts, about half (47%) reported that such accounts have made it easier to learn about health conditions.

- Similarly, four in ten (42%) indicate they feel more confident in making health decisions because of health or medical social media accounts.

Why it matters

Both patient and healthcare provider communities are increasingly relying on social media platforms for health information, with influencers helping people understand and make health and wellness decisions more than ever before. Ogilvy believes brands can embrace influence to establish relationships with patients and healthcare communities, leading to improved consumer engagement, medical adoption, and brand awareness.

Key quote

“Expert and specialist influencers are a new frontier for health and pharma brand engagement … [Those] brands that get this right will reap the benefits from a rapidly expanding creator economy” – Kim Johnson, Global CEO, Ogilvy Health.

Sourced from Ogilvy

European retail media measurement standards finalised

IAB Europe has published the final version of the Retail Media Measurement Standards for Europe, to provide media buyers with a framework for consistent metrics to compare their retail media investment.

What’s covered?

The Retail Media Measurement Standards (read them in full on IAB Europe’s dedicated retail media hub) were developed following consultations with retailers, media buyers (brands and agencies) and cover the following areas:

- Primary Media Metrics (including viewability, IVT) to ensure digital retail media ads adhere to the same standards as other digital ads.

- Attribution Metrics to ensure that brands are able to compare their advertising investments using a standard lookback window and iROAS definition.

- Additional Retail Media Insights to further elevate the unique insights that retail media networks can provide such as ‘New to Brand’.

Why the European standards matter

“These standards not only establish much-needed uniform metrics but also foster transparency, making room for greater innovation and investment in this space,” said Townsend Feehan, CEO of IAB Europe. “I am excited to see how this pivotal step allows us to collectively drive Retail Media forward over the next 12 months and beyond,” she added.

Sourced from IAB Europe

Online formats now account for over three-quarters of UK ad spend

The UK’s ad market grew 6.1% in 2023 to reach £36.6bn, according to the latest Advertising Association/WARC Expenditure Report, with online formats accounting for 78.4% of that total.

But after factoring in inflation, that growth equated to a 1.2% contraction in real terms.

Key stats for 2023

- Online formats combined grew by 11% to reach a total of £28.7bn.

- Out-of-home (+9.7%) was the only other advertising medium to record growth in 2023.

- All main media contracted: TV (-8.9%, although BVOD was up 15.9%), radio (-3.3%), national newsbrands (-6.3%), regional newsbrands (-10.1%), magazines (-9.1%), cinema (-4.2%).

- The only major product sectors to record rising display ad spend (i.e. excluding search and classified formats) last year were retail (+5.0%) and services (+4.7%), the latter almost entirely attributable to a 6.6% rise in the entertainment & leisure sector.

- 2023’s Q4 Christmas ad season topped £9.7bn after achieving growth of 7.4% year-on-year.

- Q4 growth was led by digital out-of-home (+18.1%) and BVOD (+15.9%) as well as search (+12.9%), as the traditional uplift in Golden Quarter investment was buoyed further by increased advertising activity during the Rugby World Cup.

Looking ahead

- The UK advertising market is forecast to grow 5.8% in 2024 to reach nearly £39bn, and by a further 4.5% in 2025 to top £40bn.

- Broadcast media, most notably TV (+2.6%) and radio (+2.3%), are expected to return to growth in 2024.

- Among digital formats, search (+8.9%) and online display (+6.4%) are again set to see the strongest rises, closing the year with a combined share of 77% of all spend.

- More favourable economic conditions should encourage advertisers to invest more in brand-building campaigns in 2024 and this, coupled with short-term stimuli such as the Men’s Euros in June, the upcoming General Election in the second half of the year and, to a lesser extent, the Paris Olympics in July, are expected to contribute to healthy growth in formats such as broadcaster video-on-demand (+14.1%) this year.

Sourced from Advertising Association, WARC

How KFC uses brand sponsorship to enhance sporting experience

KFC’s association with Australian sports has successfully created various distinctive brand assets, thanks to its good understanding of the audience and the environment, plus a dash of creativity that has allowed its sponsorship dollars to go further.

Why brand sponsorship matters

There are more brands than ever associated with Australian sport, but consumers are having a harder time remembering who they are, despite the significant investment required for sponsorship in this space. This makes it imperative for brands to “get it right” and not just occupy but demand the attention of the audiences they’re so keen to reach.

Takeaways

- A...

This content is for subscribers only.

Sign in or book a demo to continue reading WARC’s unbiased, evidence-based insights that save you time and help you make marketing choices that work.

Volkswagen doubles down on China as presence slips

The world’s largest car maker is aiming for an eighth of China’s automotive market with the launch of 30 new electric cars by 2030.

Why EVs matter in China

China’s massive market - of which Volkswagen enjoys a now slightly reduced 14.2% at 3.2 million vehicles shipped to China, just under 200,000 of which were electric - is vital to electrification, as it emerges as the critical arena in the electric car space.

Volkswagen’s plans come as major players in the electric space face a rocky period.

Pole position

The German OEM (Original Equipment Manufacturer, the preferred term for car assemblers) wants to remain the number one in the market, but must compete with close challenger BYD - with three million vehicles shipped, all of which are electric. VW’s EV business in China is growing at 23.2% year on year as they are expected to make up over half of the total market by 2030.

A new product mix is essential, starting with it’s China-focussed ID.CODE (pictured), which will premiere this week at the Auto China 24 trade fair in Beijing.

The company has explained that it will sharpen its strategy across three pillars:

- A comprehensive product portfolio accelerating the electrification of the brand’s models,

- A brand and design language developed specifically for the Chinese market,

- Local technical development with strong partners in China to accelerate the pace of innovation.

The brand opportunity is significant too. In a space with hundreds of manufacturers competing, there is a chance for a big international brand to leverage its equity at a time when significant demand-side perks are available to Chinese consumers.

Obstacles come in the form of short term economic pains that have troubled local giant BYD as well as Elon Musk’s Tesla, reducing revenues in the short term at a time when heavy investment in complex manufacturing is needed to sustain the electrical transition and meet consumer demand.

Sourced from Volkswagen, Morning Brew, WARC, SCMP

Why you need to focus on brand love before brand need

How consumers feel about a brand, more than need, drives stronger engagement with marketing, according to new research.

Key figures

- Sixty percent of respondents in a study* by martech company Epsilon said they engage with a marketing message because they are “familiar with and like the brand”.

- Fifty-six percent said they interact because they want to know more about a new brand or product.

- Just 37% of respondents indicated their engagement is driven by need.

Why it matters

“These findings remind marketers of the importance of creating relationships with consumers that are not just transactional, given ‘brand’ is the context in which all purchase decisions are made,” said Jeff Smith, chief marketing officer at Epsilon.

“The implication is that marketers need to stop thinking of ‘branding’ or ‘performance’ as separate and disconnected initiatives. Effective marketing and media not only capture sales in the moment, but also build relationships with your brand that drive more purchases over time.”

The importance of personalisation

- Two-thirds of respondents said brands have become better at personalising advertising and marketing, but almost all see at least one irrelevant ad every day.

- Three-quarters of respondents said they view brands negatively when they include inaccurate information about them in their advertising and messaging.

- Less than half of respondents felt they have some control over how brands engage with them.

*The Push and Pull of Personalization is based on responses from 600 US consumers aged 18-65.

Sourced from Epsilon

How long do the profits from advertising take to materialise?

Advertising has an average short-term profit ROI of £1.87 per pound invested which increases to £4.11 when sustained effects are included; a major new study concludes that 58% of advertising’s total profit generation happens after the first 13 weeks.

Context

Profit Ability 2: the new business case for advertising*, commissioned by TV industry body Thinkbox, is an update and expansion on a similar 2017 study, which found that TV ads drove 71% of advertising-generated profit.

The latest report analyses the profit generated by advertising at different stages as its effects build over time: immediate (within one week); short-term payback (up to 13 weeks); sustained payback (week 14 through to 24 months); and full payback (0-24 months).

Channel breakdown

- TV accounts for 54.7% of advertising’s full payback but only accounts for 43.6% of total advertising investment. Within this, Linear TV accounts for 46.6% of full payback and BVOD accounts for 8.2%.

- Online Video (which is mostly YouTube) has an average full profit ROI of £3.86 for every pound spent and accounts for 3.4% of full advertising-generated profit.

- Generic PPC (unbranded online search) offers the highest immediate payback, but its effects rapidly diminish after the first week and it has a weak sustained payback.

- Linear TV is the second strongest performer for immediate payback, followed by Paid Social, Audio and BVOD.

- TV also has the highest saturation point: advertisers can increase investment here to a higher level than other media and it will continue to generate a profitable return.

ROI varies by sector

- Full profit ROI varies by sector: in the automotive sector, for example, it’s £4.65 per pound invested, more than double the figure for the financial services sector (£1.95).

- That’s down to nuances in the different business environments, including the value of products, operating margins and the relative strength of advertising on sales.

Why advertising payback matters

“This is about the strength of advertising as a business investment that grows the bottom line and grows the economy,” said Matt Hill, research and planning director at Thinkbox.

* The study was produced by Ebiquity, EssenceMediacom, Gain Theory, Mindshare, and Wavemaker UK, using their huge econometric databases of client data. The final report covers £1.8bn of media investment in the UK across 10 media, 141 brands, and 14 categories.

Sourced from Thinkbox

CTV and podcast spending surges

British advertisers are increasingly tapping into the popularity of online entertainment, as can be seen from rising expenditure on CTV and podcasts, according to the latest Digital Adspend report from IAB UK.

Key stats

- Overall, the UK’s digital ad market grew 11% to a total of £29.6bn last year – far ahead of GDP growth of 0.1%.

- Ad spend on CTV devices grew 21% YoY in 2023, while the amount invested in podcast advertising was up 23%; social video continued to perform strongly with annual growth of 20%.

- Growth rates in all three categories outperformed the digital ad market as a whole, underscoring the appeal of these channels, which stand to be more immune to upcoming cookie changes than other forms of digital advertising.

- Digital out-of-home, included for the first time, grew 12% in 2023 to £841m.

- Digital retail media spend was also up 12% to £283m, as the sector continues to prove a popular route for advertisers looking to tap into retailers’ wealth of first-party data.

- Spend on mobile advertising has accelerated, increasing 15% to £16.7bn. This is a significant uptick versus 2022 when it slowed to a 4% growth rate in the wake of Apple’s IDFA changes.

- Search continues to underpin the industry, accounting for 50% of the market at £14.7bn.

- Display grew 12% to £11.3bn fuelled by video, which accounted for over 60% of total display spend for the first time.

Putting the data in context

“With the impending deprecation of third-party cookies, digital advertising is undergoing a shift and we know that the year ahead will reshape the industry in new ways,” said James Chandler, CMO at IAB UK. “In that context, it’s encouraging to see advertisers seeking out engaged environments and increasingly investing in a broad array of online solutions.”

Sourced from IAB UK

Revolut & Chase: The retail media boom comes to banking

Financial services brands are starting to see opportunities in advertising, with Chase in the US launching a media solution and the UK’s Revolut considering one, as the same first-party storm that hit the retail world now gathers above financial services.

Why advertising matters to financial services

Selling digital ads is usually much more profitable than providing a company’s core operations because the incremental revenue is a byproduct of those operations. With young fintechs like Revolut looking for new sources of profitable revenue and established brands like Chase also in search of profitable growth, advertising appears to offer a big opportunity.

It’s not the first time that financial services and, specifically JPMorgan Chase, have dabbled in media. Back in 2021, it acquired restaurant reviews site The Infatuation. It appears that for Chase, at least, the strategy has yielded some rewards.

Revolut sees potential in media as fintech boom fades

No longer the radical upstarts of the late 2010s, fintechs or neo banks like Revolut are becoming established (even if it waits for a full banking license). But it too has felt the pull of media.

In an interview with the FT, Revolut head of growth Antoine Le Nel talked up becoming a “media business” capable of bringing in a “proper chunk” of total revenues. Internal company files shared by another source indicate that expected revenues from the project in just two years could be as much as a third of Revolut’s £923m revenues in 2022.

The company has now hired TikTok’s former head of e-commerce partnerships in the UK, Inam Mahmood, to lead sales for the new venture, indicating some seriousness.

Chase Media Solutions

In short, Chase Media will send its customers targeted deals and discounts based on their spending habits, adding a new level of sophistication and targeting to the existing Chase Offers feature. And this is thanks to the 2022 acquisition of Figg, a card-linked marketing platform.

According to a release, Chase Media Solutions “serves as a key conduit for brands, connecting them with consumers’ personal passions and interests.” At launch, the banks says it has piloted the technology through some short campaigns for Air Canada, Solo Stove, Blue Bottle and Whataburger.

In turn, the release continues, “Chase customers benefit from personalized offers and the ability to earn cash back with brands they love or are discovering for the first time.”

“Like retailers, we have first-party data and a dedicated audience. But what sets us apart is the unrivaled scale and insights from our customers,” says Rich Muhlstock, president of the new media solutions division.

Driving the story: Everything is an ad network

For the original thinking on this trend, which began in the depths of the pandemic, look to Eric Seufert’s observations on his Mobiledevmemo blog and the long list of examples confirming them.

The deprecation of the third-party cookie has floated on the horizon for many years now, as online advertising looks past the deeply flawed but democratic tracking technology of the cookie. Though there remain more potential hiccups along the way to a Google-sponsored solution, it is undeniable that marketers and media owners need to look to their own sources of data, known as first-party data.

It’s the story that makes up a significant portion of WARC’s latest Future of Measurement report (members can read here; if you’re yet to subscribe, get a sample here). At the brand level, this manifests in 71% of brands, agencies, and publishers increasing their first-party assets.

What’s new here, however, is how wildly the definition of “publisher” is deviating from its original sense, as advertising dollars fall away from their traditional destinations alongside professionally produced content. What matters to ad buyers today is audience data close to the point of purchase – for financial services brands, the step makes a lot of sense.

Sourced from the FT, Chase, WARC, Mobiledevmemo

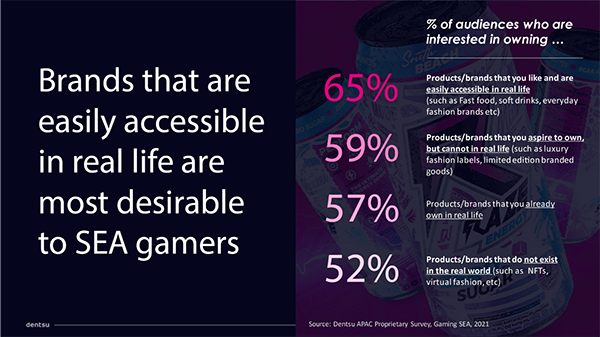

Gaming: How to create immersive and effective brand experiences

As traditional gaming arenas evolve into immersive, multi-sensory and multi-form social spaces, brands have the opportunity to curate personalised and lasting experiences to engage meaningfully with the lucrative US$5 billion gaming market in Southeast Asia and its 270 million gamers.

Why immersive brand experiences matter

Brands can build AI-enabled non-player characters to develop relationships with audiences in new ways to provide personalised and interactive real-time consumer experiences that allow AI to learn more about the consumer and conversation.

Takeaways

- Extend IRL occasions with exclusive in-game experiences and benefits to bridge the gap between virtual entertainment and real-world consumption.

- Non-player character (NPC)...

This content is for subscribers only.

Sign in or book a demo to continue reading WARC’s unbiased, evidence-based insights that save you time and help you make marketing choices that work.

Email this content